Little Known Questions About Redbud Advisors, Llc.

Your accounting professional may have even more than one classification, the most typical are Licensed Internal Auditor, Qualified Management Accounting Professional, and Qualified Public Accounting Professional. Lots of accountants choose to come to be CPAs since the designation is considered the gold standard in the accountancy profession. In the USA, qualification demands for accountants can differ from state to state.

This was greatly due to the reality that businesses expanded in intricacy and the shareholders and shareholders, who were not always a part of the company however were monetarily invested, needed to know more regarding the monetary health of the firms they were purchased. After the Great Depression and the development of the Securities and Exchange Compensation (SEC), all publicly traded business were required to release reports created by recognized accountants.

The 10-Minute Rule for Redbud Advisors, Llc

Management is in charge of the monetary details generated by the business. https://linktr.ee/redbudadv1sor. Therefore, professional accountants in organizations as a result have the task of protecting the top quality of financial reporting right at the resource where the numbers and numbers are created! Like their equivalents in taxation or auditing, expert accounting professionals in business play important functions that add to the total stability and development of culture

This is an useful asset to management, particularly in small and moderate ventures where the professional accounting professionals are frequently the only expertly certified participants of personnel. Accountancy professionals in business assist with company approach, give suggestions and assistance companies to minimize costs, boost their leading line and reduce risks. As board supervisors, expert accountants in business represent the passion of the proprietors of the firm (i.

The Best Strategy To Use For Redbud Advisors, Llc

As an occupation that has actually been presented a privileged position in society, the book-keeping career all at once handle a broad variety of problems that has a public passion angle. When it comes to specialist accounting professionals in service, not just should they preserve high standards but they also have a key duty to play in helping companies to act morally.

Accounting professionals will certainly lose their legitimacy as guards of public rate of interest if there is no public depend on. The book-keeping career has vast reach in society and in worldwide funding markets. In the most standard method, confidence in the financial information created by professionals in businesses forms the core of public depend on and public value.

Stabilizing these completing demands talks with the actual heart of being an expert unlike merely working or carrying out a function. Specialists are expected to work out specialist judgment in performing their roles to make sure that when times get tough, they do not embark on actions that will certainly lead to the career shedding the general public's trust fund as protectors of public interest.

The Ultimate Guide To Redbud Advisors, Llc

At the national level, the expert bookkeeping body is the voice for the nation's professional accountants; this includes all specialist accounting professionals both in technique and in service. Due to the fact that they play various duties in the culture, the total standing of the book-keeping career can only be reinforced when both professional accountants in method and in organization are well-perceived by culture.

Like various other careers, expert accountants are significantly tested to show their significance in the capital market and their ability to evolve and encounter new obstacles. https://folkd.com/profile/user468786529. Public expectations are high. Dispensary Regulations OKC. The worth of specialist accounting professionals will certainly be gauged by the level to which they are viewed to be liable not only to their own companies but more notably to the general public

More About Redbud Advisors, Llc

Public education and learning on the varied duties of professional accountants in company requires to be stepped up so as to boost the presence of these roles. Professional audit bodies also require to take notice of their members in business and provide them with the support they need more in order to be successful in their roles.

Those worried concerning their P&L declaration typically have a level group framework that obsesses on working with individuals to do the job on hand. In a company such as this: Absolutely nothing runs efficiently on its very own Working with the right staff is challenging Staff retention is low, The owner works long hours playing constant catchup, Little thought is placed right into working with, the emphasis is on connecting openings What's a much better option?

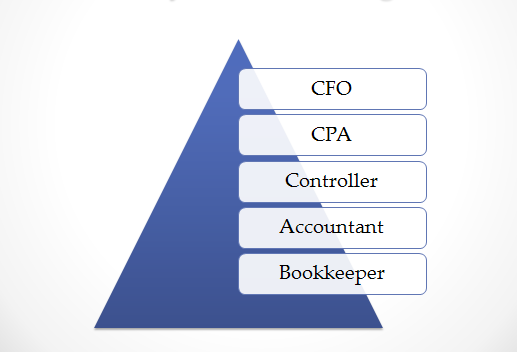

Successful companies comprehend you can not just hire someone and anticipate them to do all of the above. You require to comprehend the three most important functions in a firm: Finders are typically your elderly customer supervisors and assistant client supervisors - COGS Accounting Firm OKC.